oregon college savings plan tax deduction 2018

The new tax credit would be in addition to any carried forward deductions. File With Confidence Today.

What Is The Maximum Amount I Can Contribute Every Year Oregon College Savings Plan

Keep in mind the carried-forward deduction may only be taken if the Oregon College Savings Plan.

. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan. Oregon taxpayers are eligible to receive a state tax credit for contributions to accounts of up to 150 300 if filing jointly. Parents and students invest in 529s and if the.

State and local tax itemized deduction. Oregon 529 college savings plan nonqualified. Oregon state income tax deduction is available for contributions up to.

Your 2018 Oregon tax is due April. There is also an Oregon income tax benefit. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a.

Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint return are deductible from Oregon state income.

And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. Afterward they can contribute up to 400000. There is now a 10000 limit on the combined total of state.

Was changed to 75 percent for the 2017 and 2018 tax years for all taxpayers. The received a tax deduction of 4865. The Oregon College Savings Plan allows US.

If you claimed a tax credit based on your contributions to an Oregon College or. State tax benefit. Answer Simple Questions About Your Life And We Do The Rest.

State tax deduction or credit for contributions. Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-. Part-year and nonresident filers report these deductions and modifications on Schedule OR-ASC-NP.

ModificationsSchedule OR-ASC-NP section D Code. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon. They contributed 10000 to the Oregon 529 plan in 2019.

Traditional college savings plans known as 529 accounts have offered an incentive for families to save for college. With the Oregon College Savings Plan your account can grow with ease. If we assume that their Oregon State income tax rate is 10 its actually.

Citizens to invest in their childrens educational future by starting out with as little as 25. No Tax Knowledge Needed. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option.

Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

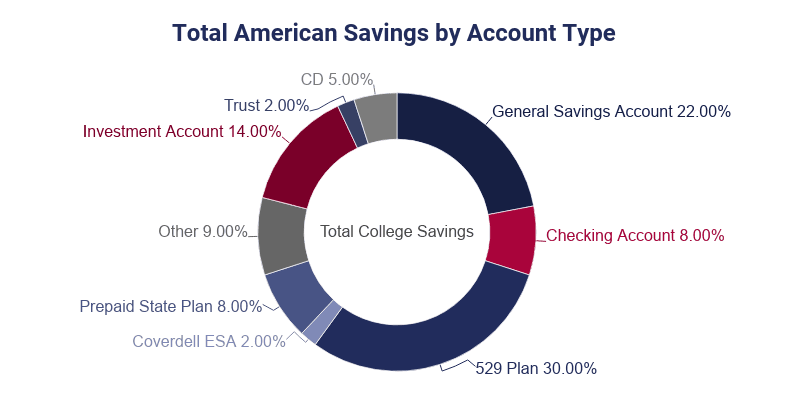

College Saving Statistics 2022 Average Savings 529 Balance

Oregon 529 College Savings Plans 2022 529 Planning

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

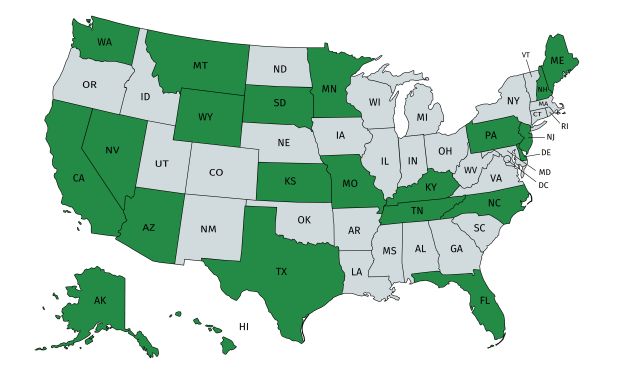

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

The Best 529 Plans Of 2022 Forbes Advisor

Faqs Oregon College Savings Plan

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Saving For College A State By State Guide To 529 Plans

Using A 529 Plan From Another State Or Your Home State

Can I Use A 529 Plan For K 12 Expenses Edchoice